Much like the late payment penalty, you can avoid the minimum penalty by showing the IRS that you have a reasonable cause for filing after the due date. Currently, this rate is about 3 percent annually. Note that you might have to pay interest on unpaid taxes. If you believe that you have reasonable cause, attach a form explaining your reasons to your federal tax extension form.

If you are going to pay your taxes late, you can avoid a penalty if you can show the IRS that you have a reasonable cause for not paying your taxes on time. The minimum penalty is $135 or 100 percent of the balance due, whichever is smaller.The maximum penalty for paying late is 25 percent of the total.The penalty for paying late is 5 percent for every month that the outstanding tax is not paid.If you might be subject to a penalty, keep the following in mind: Filing a tax extension keeps you square with the IRS and lets them know that you will be filing your complete paperwork later, but it does not grant you more time to pay the taxes you owe.

Special tax filers must ensure their federal and state tax returns are in before their extensions expire.Įven if you file an extension, you will have to pay penalties if you do not pay your taxes by the regular tax due date.

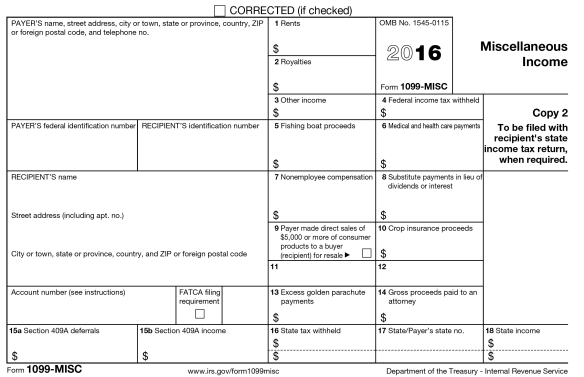

citizen or resident alien and on April 18, 2016, you must: Some tax filers will qualify for an automatic two-month extension to file their federal tax return and pay income tax. You will then receive a confirmation number for your records. You must provide relevant tax information and indicate that the payment is for a tax-filing extension using one of the IRS-approved methods of payment. To do this, pay all or part of your estimated income taxes that are due. You can even get the automatic extension without filing IRS Form 4868. Once you've filed your completed IRS tax extension form, you'll automatically get the six-month extension to file your IRS tax return.Mail your completed form to the IRS or file the form electronically by using an IRS e-file form.Get and fill out IRS extension Form 4868, Application for Automatic Extension of Time To File U.S.You can file a tax extension online or via mail by following these steps: To qualify for a tax extension, you must file the appropriate form by the standard tax filing deadline of Ap(or April 19, 2016, if you live in Maine or Massachusetts). The tax extension deadline is the regular tax deadline. October 16th, 2017 is the official deadline day for e-filing and extensions.Whether you file taxes online or file tax return forms via mail, the general process to request an extension on the tax deadline is the same.April 18th, 2017 is the last day to file your individual federal and state tax returns or extensions without IRS penalties accumulating.January 23rd, 2017 marks the first day you can e-file your 2016 tax return.January 1st, 2017 is the first day to prepare your tax return on PriorTax.That’s all there is to it! Important dates to mark on your calendar this tax season Reach out to our staff throughout the process and submit your account to e-file once you are confident.

IRS E FILE EXTENSION 2016 SOFTWARE

Our user-friendly software will guide you through your tax return preparation step-by-step. We review our customer testimonials and reviews daily to make sure we are making our site as user-friendly as possible.Ĭreate a unique username and password. We are constantly updating our site to improve customer experience.Want audit protection? We can help! Prefer to receive a paper copy of your return? We can do that too.

Opt into additional services to fit your tax needs.Our software is compatible with most IRS forms so you don’t need to worry about it. From the most basic returns to multiple forms and schedules, we’ve got you covered. We offer pricing packages to accommodate all tax situations.Reach out to our customer support team and receive quality support you just don’t get with other online tax prep sites.

IRS E FILE EXTENSION 2016 FREE

0 kommentar(er)

0 kommentar(er)